How to hire Corporate Tax Consultant in UAE

Navigating the complex world of corporate taxes might be intimidating, particularly in a fast-paced corporate climate like the UAE.

Selecting the best business tax advisor is essential to guaranteeing compliance and making the most of your tax plan. With an emphasis on business tax advice services, we will walk you through the recruiting process for a corporate tax consultant in the United Arab Emirates in this article.

Understanding the Role of a Corporate Tax Consultant

What is a Corporate Tax Consultant?

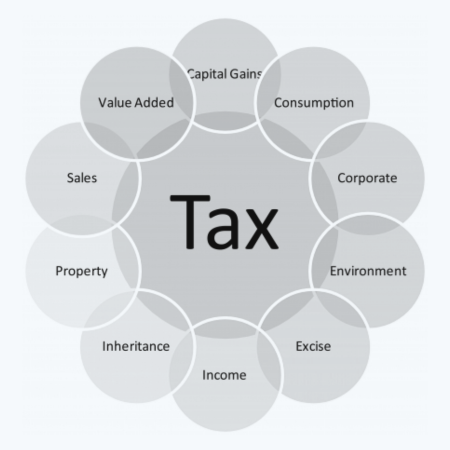

A corporate tax consultant is a professional who specializes in corporate tax laws and regulations. They provide Navigating the Complex to help businesses comply with tax obligations, minimize tax liabilities, and develop efficient tax strategies. In the UAE, where tax laws are continually evolving, having a knowledgeable consultant can be invaluable.

Why Hire a Corporate Tax Consultant in UAE

Hiring a corporate tax consultant in the UAE offers several benefits:

- Expert Knowledge: They stay updated with the latest tax laws and regulations.

- Compliance Assurance: Ensure your business complies with local and international tax requirements.

- Tax Optimization: Identify opportunities to reduce tax liabilities legally.

- Peace of Mind: Focus on your core business activities while they handle tax-related matters.

Steps to Hire a Corporate Tax Consultant in UAE

Identify Your Business Needs

Before you start searching for a corporate tax consultant, it’s essential to understand your business needs. Are you looking for help with compliance, tax planning,or both? It will be easier for you to locate the ideal consultant with the necessary expertise if you are aware of your precise needs.

Research Potential Consultants

To identify possible corporate tax consultants, do a comprehensive investigation.Look for firms or individuals who have a strong reputation and extensive experience in corporate tax advisory services.One way to get started is to ask other business owners or members of professional networks for recommendations.

Evaluate their Qualifications and Experience.

Once you have a list of potential consultants, evaluate their qualifications and experience. Consider the following:

Certifications: Ensure they have relevant certifications and qualifications.Experience: Look for consultants with experience in your industry and with businesses of similar size.

Track Record: Check their track record of successful tax advisory services.

Check References and Reviews

Consult previous customers for references, and read internet reviews.Speaking directly with previous clients can provide valuable insights into the consultant’s reliability, professionalism, and effectiveness. Look for feedback on their ability to deliver timely and accurate tax advice.

Assess Their Knowledge of UAE Tax Laws:

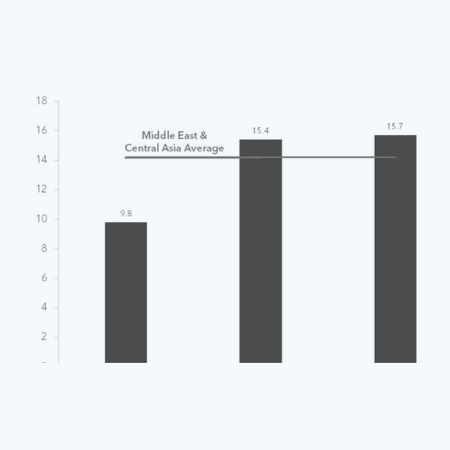

UAE tax laws can be complex and subject to frequent changes. Ensure the consultant has in-depth knowledge of the local tax landscape. They should be able to explain recent updates and how they affect your business. A good corporate tax consultant in UAE will also be familiar with international tax laws if your business operates globally.

Discuss Fees and Services

Understand the fee structure and the range of services offered by the consultant. Some consultants charge hourly rates, while others may offer fixed fees for specific services. Make sure there are no hidden costs and that you clearly understand what services are included.

Evaluate Their Communication Skills

Effective communication is vital in a consultant-client relationship. The consultant should be able to explain complex tax matters in simple terms and be available to answer your questions promptly. Good communication ensures you stay informed and can make well-informed decisions.

Finalize the Agreement

Once you’ve selected a corporate tax consultant, finalize the agreement by signing a formal agreement. The scope of services should be specified in the contract. fees, timelines, and any other relevant terms. Having a clear agreement helps avoid misunderstandings and ensures a smooth working relationship.

Conclusion: Hiring the right corporate tax consultant in the UAE is critical for any business looking to navigate the complexities of tax regulations effectively. By understanding your needs, conducting thorough research, and evaluating potential consultants based on their experience and qualifications, you can find a consultant who will provide valuable corporate tax advisory services. This strategic partnership will not only ensure compliance but also optimize your tax strategy for long-term success.

FAQs About Hiring a Corporate Tax Consultant in UAE

Frequently Asked Questions (FAQ)

A corporate tax consultant in UAE provides advisory services to assist companies in adhering to tax regulations, minimize liabilities, and develop effective tax strategies. They remain current on the most recent tax laws and ensure your business adheres to them.

A corporate tax consultant can benefit your business by ensuring compliance, identifying tax-saving opportunities, reducing liabilities, and freeing you up to concentrate on your main tasks. Their knowledge can reduce risks and result in large cost savings.

Look for qualifications, relevant experience, industry knowledge, references, and communication skills. Ensure they have a deep understanding of UAE tax rules and can offer specific guidance to meet your company’s requirements

Yes, many corporate tax consultants in the UAE have expertise in international tax laws. They can assist with cross-border tax issues, ensuring your business complies with global regulations and avoids double taxation

Regularly consult with your corporate tax consultant, who will keep you informed of any changes in tax laws and how they impact your business. Implementing their advice ensures ongoing compliance and optimal tax management

Popular Post

Business Analysis Consulting Services

Bookkeeping for Cash Flow Management

What Are the Different Types of Bookkeeping Services?

Introduction to Accounting and Bookkeeping Services