VAT Consultant In Abu Dhabi

VAT Consultants in Abu Dhabi

Value Added Tax (VAT) consultants in Abu Dhabi support firms in the UAE’s VAT environment by offering VAT services in Abu Dhabi . VAT consultants offer support for planning, training, advisory services, compliance, registration, and audits. These experts are essential to corporate operations since they guarantee compliance with UAE VAT legislation and reduce tax obligations. By keeping accurate records, being informed about changes in VAT legislation, and managing VAT-related duties effectively, firms may help ensure easier financial operations and compliance with legal requirements in Abu Dhabi’s business climate.

Our Service

Why VAT is important in Abu Dhabi?

VAT implementations

VAT implementation is the process of introducing and enforcing Value Added Tax (VAT) within a

country’s tax system. It involves legislative changes, administrative preparations, registration for

businesses, education campaigns, compliance enforcement, and monitoring. VAT aims to generate

revenue, promote economic growth, and ensure fair taxation.

VAT rates

In the UAE, VAT comes in three variations:

- Standard Rate: Most things are taxed at this rate, like clothes and electronics.

- Zero Rated: Some items have no VAT, like certain food items and medicines.

- Exempted: Certain things, like residential property rentals and local transport, don’t have VAT at all.

What do you need to register VAT?

Registration for VAT involves several steps:

Why VAT is important in Abu Dhabi?

VAT (Value Added Tax) was introduced in UAE in 2018. Since then, businesses have been required to follow specific rules to stay compliant. VAT services in Abu Dhabi help businesses handle these rules easily and avoid any penalties. Here’s how VAT services can benefit your business with real-life examples:

Accurate VAT reporting

VAT services in Abu Dhabi help businesses in submitting appropriate VAT reports. This includes keeping account of all sales and purchases so that the appropriate VAT is paid. For example, a restaurant in Abu Dhabi hired VAT services to handle its tax calculations. The experts assisted them in accurately calculating the VAT on both dine-in and takeout orders, ensuring that no errors were made.

Ensure VAT Compliance

Many businesses in Abu Dhabi struggle to understand VAT requirements. VAT services help businesses stay compliant by handling everything from registration to filing VAT returns. For example, a small retail shop in Abu Dhabi employed VAT advisors to manage their VAT registration and ensure that their returns were filed on time. This allowed the shop owner to concentrate on running the business instead of worrying about legal difficulties.

Save Time and Effort

Filing VAT returns can be time-consuming, particularly for small companies. VAT services in Abu Dhabi take away this responsibility, allowing business owners to concentrate on their activities. For example, a local clothing business saved hours of time each month by engaging a VAT service provider to file their VAT filings. This allowed them to spend more time on customer service and sales.

Avoid Penalties

One of the most significant advantages of hiring VAT services in Abu Dhabi is the ability to avoid fines. Missing VAT deadlines or committing mistakes can lead to significant fines. For example, a construction company that was late in filing its VAT taxes was required to pay a substantial penalty. After engaging VAT specialists, they avoided such penalties by submitting everything on schedule.

VAT Audit Support

VAT services can also aid with VAT audits. Audits occur when the government determines whether a business is paying the correct VAT. Authorities conducted an audit of a logistics firm in Abu Dhabi. Thanks to their VAT consultants, they had all of the relevant documentation available, and the audit went easily.

What VAT Services in Abu Dhabi do we provide?

We as a VAT Consultant Abu Dhabi provide a range of essential offerings tailored to meet your needs:

Additionally, CFO services can be instrumental in optimizing operational efficiency, streamlining financial processes, and enhancing overall profitability. Ultimately, engaging CFO services empowers businesses with strategic financial leadership, enabling them to make informed decisions, mitigate risks, and achieve sustainable growth.

Registration

We assist you through the process of VAT registration, ensuring all required documentation is completed accurately and submitted promptly.

Quarterly VAT Filing

Our team handles your VAT filings every quarter, ensuring compliance with regulations and deadlines, and allowing you to focus on your core business activities.

Advisory

Whether you have queries regarding VAT regulations, exemptions, or compliance, our expert advisors provide you with the guidance and support needed to navigate the complexities of VAT.

VAT Health Check

We conduct thorough assessments of your VAT processes and systems to identify any areas for improvement, ensuring compliance and efficiency in your VAT operations.

VAT Refund Support

If you’re eligible for a VAT refund, we provide comprehensive support in preparing and submitting your refund claims, maximizing your chances of a successful refund.

De-registration

When the time comes to de-register for VAT, we guide you through the process seamlessly, ensuring compliance with all requirements and facilitating a smooth exit from the VAT

system.

With our comprehensive suite of VAT services, we’re here to support you at every stage of your VAT journey, ensuring compliance, efficiency, and peace of mind.

FAQ

Frequently asked questions.

VAT consultants in Abu Dhabi are professionals or consulting firms that specialize in providing expertise and assistance regarding Value Added Tax (VAT) matters in the UAE, particularly in Abu Dhabi. These consultants offer a range of services including VAT registration, compliance, planning, advisory, training, and audit support. They help businesses navigate the complexities of UAE’s VAT landscape, ensuring adherence to regulations, minimizing tax liabilities, and facilitating smooth financial operations. VAT consultants play a crucial role in assisting businesses in Abu Dhabi to manage VAT-related tasks effectively and stay updated on changes in VAT laws, ultimately ensuring compliance with legal requirements and optimizing financial processes.

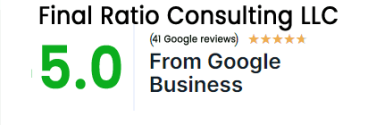

The final ratio helps with VAT registration by guiding clients through the process, ensuring accurate completion of required documentation, and timely submission to the tax authority.

In Dubai, businesses are required to file VAT returns every quarter. This means that VAT returns must be submitted every three months. It’s important to ensure timely and accurate filing to avoid penalties. Contact us for reliable VAT Services in Abu Dhabi

The benefits of VAT registration for businesses in Abu Dhabi, advised by Final ratio, include reclaiming VAT on purchases, enhancing credibility, and meeting requirements for government tenders or contracts.

Non-compliance with VAT regulations can lead to significant penalties and fines imposed by the tax authority. These penalties may include monetary fines, suspension of VAT registration, or even legal action. Businesses must maintain proper records, adhere to filing deadlines, and comply with all VAT regulations to avoid such consequences.

The value added tax (VAT) in Abu Dhabi is currently set at 5%. This means that for most goods and services, an additional 5% will be added to the final price. For more detailed advice on VAT in Abu Dhabi and its impact on your business,

Up to 85% of the VAT paid by visitors may be refunded. The reimbursement procedure might be facilitated by a VAT consultant Abu Dhabi

The Federal Tax Authority (FTA) collects VAT in the UAE. A VAT consultant in Abu Dhabi can help ensure your business complies with FTA regulations.

The latest VAT rule in UAE, set to take effect in 2025, brings stricter compliance and reporting requirements. This means businesses and individuals alike will need to stay on top of their VAT obligations or risk facing penalties. That's where our VAT Services come in with the help of our experienced consultants in Abu Dhabi, we can guide you through the changes and ensure your

compliance with the new regulations. Call us for VAT Consultation in Abu Dhabi

Businesses registered for VAT and eligible tourists can claim refunds. A VAT consultant in Abu Dhabi can assist with the claim process.

Under the UAE VAT law, any business with an annual turnover of AED 375,000 or more is required to register for and pay VAT. This includes all businesses, regardless of size or industry. Additionally, non-resident businesses making taxable supplies in the UAE are also liable for VAT registration and payment. Call for expert VAT consultancy.

As per the regulations set by the Federal Tax Authority, if your firm's taxable supplies and imports exceed AED 375,000 in a year, you are required to register for VAT in Abu Dhabi. It is also recommended to register once you anticipate reaching this threshold in the near future

Noncompliance with VAT regulations can lead to serious consequences, including fines, penalties, and even legal action. That's why it's crucial to ensure complete compliance with the help of VAT services in the UAE.

In order to claim VAT on certain business expenses, you must have the appropriate paperwork. To recover VAT, VAT services assist in making sure all of your records are in order.