VAT Consultant in Sheikh Zayed Rd Dubai

VAT Consultant Sheikh Zayed Rd

VAT Consultant in Sheikh Zayed Rd, Dubai play a crucial role in helping businesses navigate the complexities of the value-added tax (VAT) landscape in the UAE. VAT consultants in Sheikh Zayed Rd provide expert guidance on VAT registration, compliance, planning, training, advisory services, and audit support. By ensuring businesses adhere to UAE VAT regulations, these consultants assist companies in minimizing tax liabilities while staying compliant with the law.

The introduction of VAT in the UAE has significantly impacted businesses, and having an experienced VAT consultant ensures that businesses can efficiently manage VAT-related tasks, maintain accurate records, and stay updated on changes in VAT laws. These consultants contribute to smoother financial operations and compliance with legal requirements, which is especially vital in Dubai’s fast-paced and competitive business environment.

Our Service

Why VAT is important in Dubai?

VAT (Value Added Tax) is a significant element of the taxation system in the UAE, particularly in Dubai, and it has far-reaching effects on businesses, consumers, and the government. Understanding the importance of VAT in Dubai is crucial for all businesses to remain compliant and to maximize the benefits of the system. Below are some of the key reasons why VAT plays an important role in Dubai

Revenue Generation

One of the most significant purposes of VAT is revenue generation for the government. The taxes collected through VAT contribute to public services and infrastructure projects, including healthcare, education, transportation, and more. This revenue is critical for the government to fund essential services and ensure the country’s continued economic growth and development.

Economic Stability

VAT provides a consistent and reliable stream of income for the government, helping maintain the stability of the UAE's economy. This tax ensures a stable flow of revenue that can be used to finance public expenditures, reduce the reliance on oil revenues, and promote sustainable economic growth.

Fairness and Equity

VAT is a consumption-based tax, meaning that it is levied on the goods and services that individuals and businesses purchase. This makes it a more equitable form of taxation because it is based on consumption rather than income or wealth. As a result, VAT ensures that all individuals and businesses contribute to government revenues in proportion to their consumption, promoting fairness within the tax system.

Reduced Reliance on Oil Revenue

For countries like the UAE, which have historically depended on oil revenues, VAT helps diversify the government’s revenue base. By broadening the tax base and collecting revenue from a wide range of economic activities, VAT reduces the reliance on volatile oil prices. This makes the government’s revenue system more resilient to fluctuations in oil prices and helps to stabilize the overall economy.

Encouragement of Fiscal Discipline

VAT encourages fiscal discipline by promoting transparency and accountability in government finances. The taxes collected through VAT are subject to proper accounting, and governments are incentivized to manage public expenditures efficiently to meet revenue targets. This leads to better financial planning and more responsible management of public fund

International Competitiveness

Many countries worldwide have adopted VAT systems, and harmonizing VAT regulations helps to align the UAE's tax system with global standards. This alignment facilitates international trade, making the UAE more attractive to foreign investors and helping businesses in the UAE compete globally by adhering to internationally recognized tax practices.

VAT Implementations in the UAE

VAT implementation refers to the process of introducing and enforcing VAT within a country’s tax system. This includes legislative changes, administrative preparations, registration for businesses, education campaigns, compliance enforcement, and ongoing monitoring. Implementing VAT successfully is essential for generating government revenue, promoting economic growth, and ensuring a fair tax system.

In the UAE, VAT was introduced on January 1, 2018, and businesses must adhere to the regulations set by the Federal Tax Authority (FTA). The implementation of VAT in Dubai brought about significant changes, requiring businesses to update their accounting systems and maintain accurate VAT records. Having a VAT consultant in Sheikh Zayed Rd helps businesses comply with these regulations efficiently and stay up-to-date with the latest changes.

VAT Rates in the UAE

The UAE VAT system includes three main VAT rates, which businesses must understand to manage their tax obligations effectively:

- Standard Rate: The standard VAT rate in the UAE is 5%, which is applied to most goods and services, including electronics, clothing, and hospitality services.

- Zero-Rated: Certain essential goods and services, such as some food items, medicines, and exports, are subject to a 0% VAT rate. This means that VAT is not charged, but businesses can still claim VAT refunds on inputs.

- Exempted: Certain goods and services are exempt from VAT entirely, including residential property rentals, healthcare services, and local public transportation.

Do you have questions? Contact our VAT consultant, Sheikh Zayed Rd

What do you need to register VAT?

Registering for VAT is a necessary step for businesses in the UAE, particularly those whose taxable turnover exceeds the mandatory registration threshold set by the Federal Tax Authority (FTA). The VAT registration process involves several steps to ensure that your business complies with VAT regulations:

VAT Service in Dubai

VAT services in Sheikh Zayed Rd UAE, provide a wide range of solutions to ensure your business complies with all VAT regulations. Whether you are looking for assistance with VAT registration, quarterly filings, or VAT refund claims, our team of experts is here to guide you through every step of the process.

VAT Registration Assistance

We assist businesses with the VAT registration process, ensuring that all necessary documentation is completed accurately and submitted promptly. Our experts ensure that your business meets the FTA’s requirements for VAT registration, helping you avoid delays and penalties.

Quarterly VAT Filing

Our team handles your quarterly VAT filings, ensuring compliance with deadlines and regulations. We ensure that all VAT returns are filed accurately and on time, helping you focus on your business operations without worrying about VAT compliance.

VAT Advisory Services

If you have any questions regarding VAT regulations, exemptions, or compliance, our VAT consultants are here to provide expert advice and support. We can help clarify any doubts and provide guidance to ensure that your business operates efficiently within the VAT system.

VAT Health Check

Our VAT health check service involves a thorough assessment of your VAT processes and systems. We identify any areas of improvement and help optimize your VAT operations to ensure compliance and efficiency.

VAT Refund Support

If you’re eligible for a VAT refund, we offer comprehensive support in preparing and submitting your refund claims. Our team will ensure that you maximize your chances of a successful VAT refund, helping your business recover any overpaid VAT.

VAT De-registration

When the time comes to de-register from VAT, we guide you through the process to ensure compliance with all requirements. Our team will help you complete the de-registration process smoothly and efficiently, ensuring that your exit from the VAT system is handled properly.

With our comprehensive suite of VAT services in Sheikh Zayed Rd, Dubai, we provide support at every stage of your VAT journey, from registration to compliance, advisory, refunds, and de-registration.

FAQ

Frequently asked questions.

VAT Consultant in Sheikh Zayed Rd in Dubai are professionals or consulting firms that specialize in providing expertise and assistance regarding Value Added Tax (VAT) matters in the UAE, particularly in Dubai. These consultants offer a range of services including VAT registration, compliance, planning, advisory, training, and audit support. They help businesses navigate the complexities of UAE’s VAT landscape, ensuring adherence to regulations, minimizing tax liabilities, and facilitating smooth financial operations. VAT consultants play a crucial role in assisting businesses in Dubai to manage VAT-related tasks effectively and stay updated on changes in VAT laws, ultimately ensuring compliance with legal requirements and optimizing financial processes.

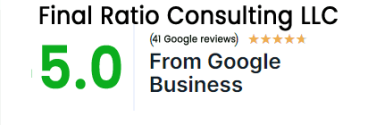

The final ratio helps with VAT registration by guiding clients through the process, ensuring accurate completion of required documentation, and timely submission to the tax authority.

In Dubai, businesses are required to file VAT returns every quarter. This means that VAT returns must be submitted every three months. It’s important to ensure timely and accurate filing to avoid penalties.

The benefits of VAT registration for businesses in Dubai, include reclaiming VAT on purchases, enhancing credibility, and meeting requirements for government tenders or contracts.

Non-compliance with VAT regulations can lead to significant penalties and fines imposed by the tax authority. These penalties may include monetary fines, suspension of VAT registration, or even legal action. Businesses must maintain proper records, adhere to filing deadlines, and comply with all VAT regulations to avoid such consequences.